Retirement savings are a serious challenge in Mexico. With a low overall participation in the formal pension system and one of the highest rates of elderly poverty in the region, it is essential for workers to make voluntary savings to ensure their financial health during retirement. Unfortunately, less than 1% of account holders actively save for their retirement. That’s why ideas42 has been working in partnership with MetLife Foundation on multiple fronts since 2015 to help overcome the barriers to retirement savings in Mexico using insights from behavioral science.

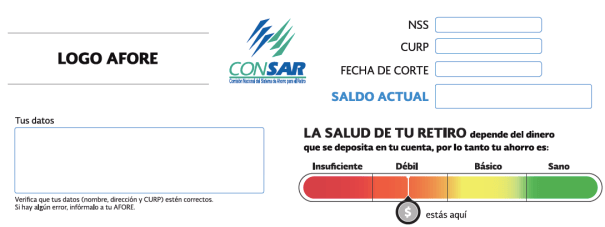

In an exciting new intervention, we worked with the regulator of the pension fund industry (CONSAR) to redesign the yearly retirement account statement and make it easier for people to quickly grasp the current state of their retirement savings, how much they need to save, and what specific action steps will get them to a healthy retirement. Starting last month, the new statements are being sent to 21 million account holders across Mexico. Based on the projections from our original pilot study, we estimate that tens of thousands of new savers will start making voluntary contributions, collectively saving hundreds of millions more pesos than before.

Throughout the statement, we aimed to deliver simple, clear and easily digestible advice to encourage workers to save. The statement includes four key behavioral features and levers, each designed to help recipients overcome barriers to saving.

1. A key insight from our original diagnosis work is that most people are not aware of the state of their retirement savings. So, we included a visual “thermometer” to highlight the overall health of the client’s retirement account in a salient, easily digestible way.

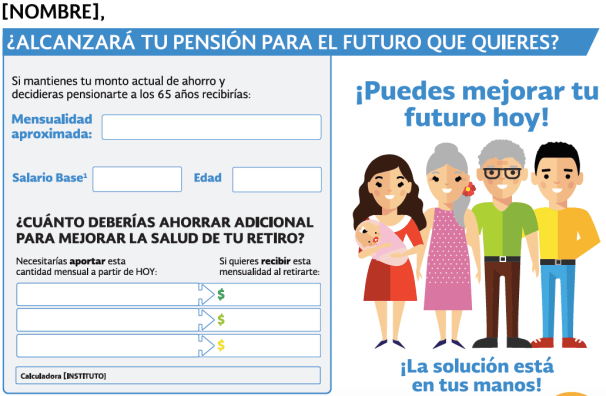

2. We know from behavioral science that people typically don’t spend time planning explicitly how much they will need when they retire. It’s hard to save when there is no specific goal. To combat this, we added a simple table showing the monthly pension a client would receive at their current savings rate, contrasted with alternative, healthier balances at other savings rates. This will help clients plan savings that are consistent with their financial expectations for retirement.

3. We also included an illustration of a happy family to frame retirement savings in a positive light. Reconnecting people back to the reasons they save, such as supporting their loved ones, can be a powerful motivator.

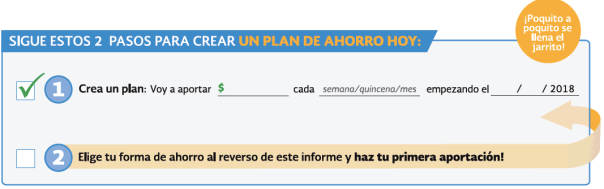

4. Finally, we know that people can be dissuaded from acting when next steps are complicated or unclear, so the statement concludes with an easy two-step plan for account holders to take tangible actions toward healthy voluntary savings.

View a comparison of the original and redesign retirement statements here.

We look forward to measuring the impact of the features of the redesigned statement and using key findings in our future work. Stay tuned for more about the rollout of retirement statements across the country, and to learn more about other projects in our comprehensive package of behavioral solutions designed to increase retirement savings and combat elderly poverty in Mexico.