Building financial health with digital financial services

Today, there’s a digital tool for almost every aspect of financial management, from automated savings and investment to expense tracking to person-to-person payments. Compared with traditional brick-and-mortar financial services, digital financial services can offer greater accessibility and convenience at lower prices. Features such as real-time notifications and automated transfers can help people avoid fees and stay on track with critical goals such as paying down debt and saving for the future. The combination of convenience, affordability, and functionality that digital financial services offer can support greater financial health.Many people aren't using helpful digital financial tools

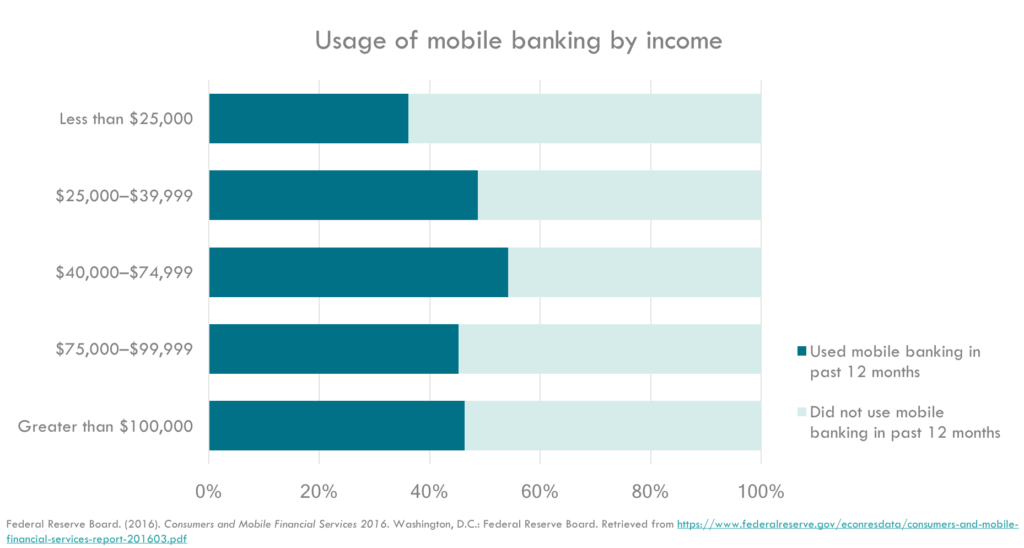

The number of people using digital financial services is growing, but take-up is far from universal across different kinds of services and income levels. For example, while over 70% of banking customers in the United States use online banking, only 38% use mobile banking apps. In addition, some mobile payments, like bill pay, are popular, but nearly half of respondents to a 2016 Pew survey had never heard of using mobile phones to send or receive money to other people. At lower levels of income, the use of mobile phones and smartphones generally decreases, reducing access to digital products. This gap in engagement can lead to missed opportunities for building financial health – especially for low- and middle-income consumers and those whose needs may not be fully met by traditional financial products.